Tax deduction calculator

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Estimate your state and local sales tax deduction.

Sales Tax Deduction Calculator Internal Revenue Service Tax Deductions Internal Revenue Service Sales Tax

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

. 11 income tax and related need-to-knows. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Partner with Aprio to claim valuable RD tax credits with confidence. Get 3 Months Free Payroll.

For FY 2020-21 AY 2021-22 2021-2022 2020-21 with ClearTax Income Tax Calculator. Ad Find Tax Credit Calculator. Your household income location filing status and number of personal.

Ad Get the Latest Federal Tax Developments. How It Works. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. That means that your net pay will be 40568 per year or 3381 per month. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Income Tax Calculator - How to calculate Income taxes online. Transfer unused allowance to your spouse. You can enter your current payroll information and deductions and.

Federal and State Tax calculator for 2022 Annual Tax Calculations with full line by line computations to help you with your tax return in 2022. Process Payroll Faster Easier With ADP Payroll. Estimate your federal income tax withholding.

Get Started With ADP Payroll. Ad Calculate Your Payroll With ADP Payroll. Use this tool to.

Check your tax code - you may be owed 1000s. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. 18 of taxable income.

Get ideas on common industry. And your spouse claims the standard deduction you. Ad Get the Latest Federal Tax Developments.

Choose the right calculator. Free tax code calculator. Thats where our paycheck calculator comes in.

Our online Annual tax calculator will. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Use our Self Employed Calculator and Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers.

Tax withheld for individuals calculator. The Tax withheld for individuals. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

For taxpayers who use married filing separate. See how your refund take-home pay or tax due are affected by withholding amount. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Use this calculator to help you determine the impact of changing your payroll deductions. There are 3 withholding calculators you can use depending on your situation. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Ad Generate clear dynamic statements and get your reports the way you like them. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Sales Tax Deduction Calculator.

40680 26 of taxable income. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms. Get paid faster with electronic invoicing and automated follow-ups. How to use BIR Tax.

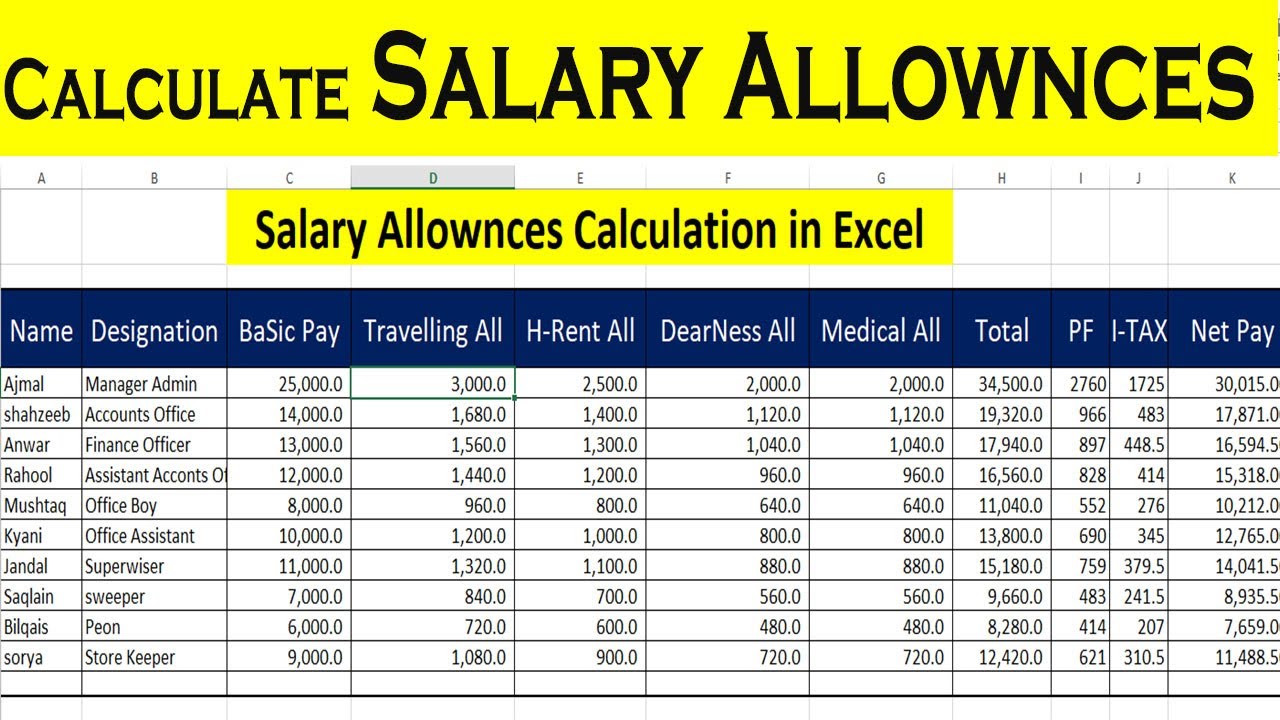

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Interest Tax Deductions Mortgage Interest Rates

Tax Calculator Calculator Design Financial Problems Calculator

Donation Calculator Spreadsheet Inspirational Goodwill Values Tax Golagoon Donation Tax Deduction Tax Deductions Spreadsheet Template

How To Organize Your Taxes With A Printable Tax Planner Business Tax Deductions Expenses Printable Business Tax

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Download Itemized Deductions Calculator Excel Template Exceldatapro Excel Templates Deduction Calculator

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Income Tax Calculator For India Infographic Income Tax Income Budgeting Finances

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Pin On Education